Hi everyone, welcome back!

In the previous postings, we have made detailed observations and studies into the secular market cycles over the past century. This is important to successful investing because cyclical changes in market conditions often have a critical impact on assets allocation decisions and investing strategies and outcomes.

Successful investing requires understanding the movement of money and funds across asset classes, markets and critically, across sectors in the equity market (our focus today). Money flows from one sector to the next as price changes reflect varying degrees of growth and risk premiums in response to anticipated changes in macro conditions. Growth can relate to prospects of the companies or the economies while risk can relate to crisis unfolding in the industry, the companies themselves or the macro-economic and geopolitical uncertainties. In short, market prices will continuously seek to price in anticipated growth opportunities and risks.

As these trends are driven by some underlying fundamentals rather than technical considerations, they can last from months to even years. Hence sectors which are over-bought (over-sold) can remain over-bought (over-sold)for a long time.

In this posting, I will share with readers specifically the concept of Sector Rotation. To appreciate its importance, one only has to recognise that 50% of a stock's price movement can be attributed to its sector's price movement. If a sector is in favour (money pouring in), even mediocre stocks in this sector will perform well. As a rising tide lifts all boats. Conversely, if a sector is falling out of favour (money flowing out), even the best stocks in this sector will be hard pressed holding up their prices.

As different economic sectors are stronger at different points in the economic cycle, money will anticipate this and flow into different sectors at various points in time. Below is a Sector Rotation Model explaining which sectors may benefit at various points in the economic cycle. Note that the financial markets will always lead the physical economy by at least 6 months as investors collectively anticipate future developments. That is why you see stock markets bottoming out and rebounding when the physical economy may still be deep in recession and where maximum pessimism often prevails.

|

| Source: Sam Stovall's S&P's guide to sector rotation. |

The economy and stock market cycles go through four phases.

1. Economy in full recession. Stock Market often bottoms out.

In this phase, economy is contracting, Fed cuts rates, consumer expectations bottoming and yield curve steepening.

Best performing sectors are: Basic Materials, Technology, Industrials and Finance

2. Economy in early recovery. Stock Market is in a bull run.

In this phase, economy starts to expand (moving out of recession), consumer spending rising, industrial production growing, yield curve turned upward sloping.

Best performing sectors are: Industrials (peaking near beginning of this phase), Technology (peaking near beginning of this phase), Consumer Discretionary, Energy (beginning near end of this phase)

3. Economy in full recovery. Stock Market topping.

In this phase, as economy expands strongly, Fed raising rates to fight near-term inflation, yield curve flattening, consumer expectations beginning to decline, industrial production flattening or declining.

Best performing sectors are: Energy (peaking near the beginning of this phase), Consumer Staples (beginning near the end of this phase), Health Care (beginning near the end of this phase)

4. Economy in early recession. Stock Market in a bear run.

In this phase, waning GDP growth, consumer expectations in the pits, industrial production declining, intrest rates are high and peaking, yield curve is flat or inverted as uncertainties about the future impact on long-term corporate borrowing and investments.

Historically profitable sectors are: Health care, Consumer staples, Utilities.

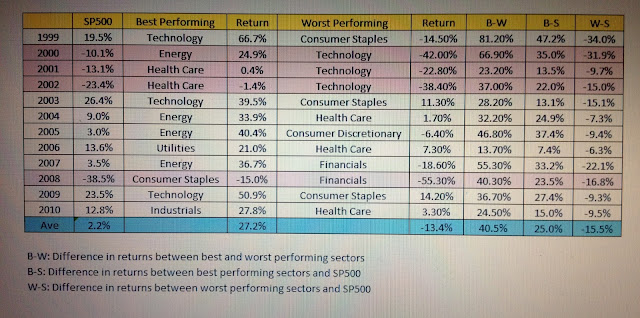

Below is the actual performance of the best and worst performing sectors since 1999. As you can see, pursuing a sector strategy can proof very profitable. The best performing sectors out-perform the S&P500 by an average of 25% while worst performing sectors under-perform the S&P500 by an average of 15.5%.

By identifying the strong sectors and buying the best stocks in only those sectors while avoiding stocks from out-of-favour sectors, you will have given yourself a critical edge with improved odds of successful investing. What is encouraging to note is one can out-perform the market without necessarily taking on excessive risks by being invested in these strong trending sectors or the best stocks found there.

In the next few postings, I will talk about how sector investing is more effective than international investing to achieve diversification benefits and by studying sector volatilities, to suggest a low-risk investing strategy that can still generate superior returns riding on sector momentum.

I will then share with you ways to identify strong trending sectors as money move into these sectors, which always will last for months or years, giving the investors adequate time to respond and take advantage of these opportunities.

Stay tuned in two weeks' time!

No comments:

Post a Comment