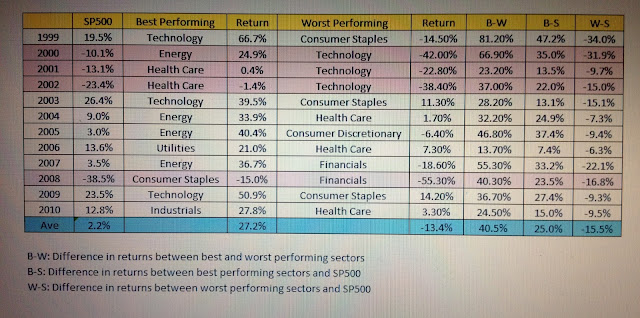

In the last two postings, you have seen how investing in the strong trending sectors can outperform the market by an average of 25% per year. A worst performing sector, on the other hand, would have generated an average of 15.5% lower returns than market. Understanding where institutional funds are flowing based on an understanding of economic cycles will give us a clue on what the leading sectors will be. I also shared how a longer-term strategy of selecting low-volatility (ie. low beta) sectors will generate the best sector returns. Going further, it is possible to select low-volatility (ie. low beta) stocks from low-volatility (ie. low beta) sectors but with nice earnings growth to boost longer-term returns.

This week, I will touch on how sector investing, with its many benefits, can achieve diversification that will especially help during this decade of turbulence as we ride out the remaining half of the 20-year secular bear market.

First, you see from the table T1 below that 52% of a stock price movement is attributable to company specific developments, with the remaining half impacted by prevailing market and sector conditions. While local market influence on a stock price movement is waning (from 23% in 1995 to 15% in 2008), we see global sector influence on a stock price movement increasing (from 7% in 1995 to 18% in 2008).

|

| T1 : Influences on stock performance |

Second, as seen in table T2, the correlation of monthly returns between SP500 and international EAFE index has risen from 0.5 in the 70s to 0.82 in the past decade. International investing hence gives little diversification benefits now as markets become more inter-connected due to globalisation.

|

| T2 :Correlation of Monthly Returns : S&P500 vs EAFE |

Third, this correlation is even stronger during bear markets than bull markets as seen in the table below. A panic in one market can easily spread across to another like wild fire. International investing does little to diversify risks during bear markets, when capital preservation and risk reduction are most critical. This is evidenced in table T3.

|

| T3 : Bear and Bull Market Correlation of Monthly Returns |

Fourth, table T4 reveals that sector investing can be more effective in achieving diversification in a portfolio as correlations between sectors and S&P500 can go as low as 0.40 over the past 10 years.

|

| T4 : Correlations across sectors & S&P500 |

In summary, if you have a relatively large portfolio and see the need and benefits to diversify, you will do better by investing in multiple different sectors than just investing across international markets. Due to globalisation, few markets, if any, are spared from any global meltdown.